I started saving with Fidelity Bank in 2014. After using Nedbank for close to a year with their top of the line online banking and their solid MasterCard support, I wanted, if not more, at least something at par with their services here in Ghana.

TL;DR. – If you are thinking of banking with Fidelity for your Debit Card (VISA) needs, for online transactions etc, then stop. Fidelity is NOT the option for you. I’ve been there, and it is horrible!

I’m personally switching to Barclays Bank; recommended solidly by a friend who left Fidelity in search of greener pastures, which she found.

Fidelity has been good for the most part. In recent months, the bank seems to be going rogue, and the raincheck I’ve had to switch needs to be finally fulfilled. How I wish Bank of Ghana would take over them too, just like happened to UT. Non-delivering banks should not be standalone.

BoG should just sweep them under its bed, so that the serious banks can stand tall and move on.

Fidelity is worsening by the clock, and it is bad. They’ve been in existence just 10 years, however their lack of seriousness and professionalism bothers me a lot.

Lemme tell you how Fidelity once treated me.

I would go file a card complaint. The lady would give me a form to fill. I did so on 3 different occassions. Guess what, She NEVER actually logged my complaints on the system.

Each time, I went home thinking it’ll be resolved. Apuuu! She likely just ditched the form she gave to me to fill in the trash can, and probably said in her mind: ‘Fa wo nkwaseasɛm fi yɛn so.’

After following up the card issue to the cards department at Fidelity was only when I got to learn, all my attempts at filing a complaint at the A&C mall was just cos90.

As a one-off instance this might appear to be, the attitude generally runs through Fidelity.

Their lack of transparency and urgency to pressing customer issues is just unacceptable, and thus need to change. And since their track record dictates there isn’t gonna be a change, how about I change and switch instead?

Well…

In my line of work and entertainment, making online payments is second nature. As I write this, these are the pending online transactions I have to complete:

- Renew 2 domain names

- Pay my monthly hosting subscription (happens every month)

- Subscribe YouTube Red (Just because of “MindField”)

Unfortunately, I am unable to complete any of the above, for more than 2 weeks now, and Fidelity Bank has shown no effort in rectifying the issue, no explaining what the problem really is.

And oh, it ain’t a one-time issue, or with only me. A friend of mine complains a similar trouble. You wouldn’t notice until you heavily depend on your debit card for online transactions.

Considering how their card system issues appear to be frequently recurring, I won’t be surprised little, if not none employees at Fidelity actually use their own bank’s issued card. They probably using other bank issued debit cards, and in turn, shoving down our throats a douchebag experience.

The Problem

Since 2014, the Fidelity VISA Gold Card issued me worked for the most part. A few issues here and there, but things get resolved eventually over a relatively short period of time.

Ever since I received another Fidelity VISA Gold Card after the initial one expired, it has been torture. It is less than 60 days, and there’s been over a dozen issues I’ve had with the card in relation to my online transactions.

Sadly, I am not alone. I know a friend, who as a result of this nonsense from Fidelity in relation to their debit cards, has switched to Barclays Bank.

Here’s the Craziness

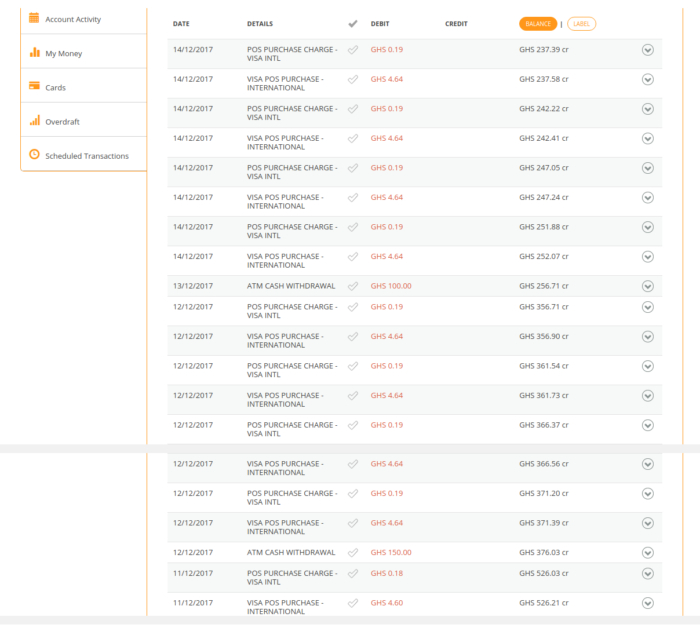

UPDATE: I received a detailed PDF document of my bank statement, showing transactions since January this year.

To my surprise, there were actually refunds. Refunds that doesn’t reflect in my bank statement IN my Fidelity Bank online banking side.

Which goes to confirm why the customer care lady saw something different than mine.

I’ve stopped relying on the online banking thing of Fidelity. It is functionally broken in a way.

Take this (my bank statement) as the specimen.

There are a few problems with the above statement:

- Obviously, I’m a poor guy

- All transactions on the 14th failed, yet there were deductions and NO REFUND happened. If refunds truly happen, I believe they’ll reflect in the “Credit” column. But refunds don’t happen.

- All transactions (the online ones) on the 12th also failed. Amount deducted for transactions, yet Fidelity didn’t release the actual money requested. Cheat!

The problem is when you try to pay for an item using your VISA Card from Fidelity, here’s what happens:

- VISA reaches out to the card’s origin bank.

- Fidelity bank tells VISA, ‘Get the heck outta here’

- VISA, therefore, informs the merchant (GoDaddy, DigitalOcean, YouTube etc) that the transaction failed because the bank wouldn’t release the money

- BUT, a BIG BUT, Fidelity will CHARGE a fee for the failed transaction.

According to Fidelity, this charged fee is refunded. But do you see it refunded in the above statement?

Now this fee charged is different from what you see when you add your debit card first time to an online store or something. Those cases, the merchant would simply touch your bank account and deduct, in many cases, just 1$ (roughtly 4.5 Cedis), then after an hour or so, the merchant will reverse that money back.

It is done just to see if the card is actually alive and working.

In all, the worst part of the statement above is, according to Fidelity, my statement is wrong, which leaves in a state of purgatory. Their online banking is an illusion.

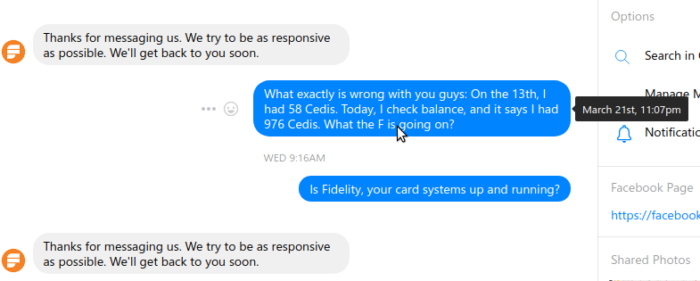

Transactions only reflect hours, if not days after it happens. The values are just miscalculated. According to the lady, the statement she saw in relation to my account on their system is NOT what I shared with her.

So if I walk around saying I have 50 cedis in my account (thanks to my online banking account), on Fidelity’s computers, I very likely has only about 10 cedis.

I always thought bank statements reflect how much the customer has in his/her account. But Fidelity is telling me, I can’t trust what they even tell me.

Today it is bloated. Tomorrow?

Would you believe although I had about 50 cedis in my account some time ago, I checked my balance to see I had 900+ Cedis?

The Solution

If you rely heavily on online transactions for the running of your business and for that of clients, you may wanna consider steering away from Fidelity.

It is a shame that even if one wants to force local businesses on themselves, in an attempt to promote them, our dear businesses manage to shit in our faces and rub poo in our noses.

I of all people should have known better.

I hereby won’t recommend any other option. However, as per the recommendations friends have given me, I’m leaning towards Barclays Bank.